CREDIT RESTORATION

CREDIT RESTORATION

Often, the "roadblock" to becoming a homeowner, whether you are a first time home buyer or otherwise, is a credit issue. As such, a credit restoration program could be in order.

Here at RadiantNewHorizonHomes.com, we want you to be able to own that 'Ideal Home' that you may dream of. So, we can assist you in every step of the process, from finding the home, to getting the terms right for you and also in obtaining the financing so you CAN own your 'Ideal Home'.

|

Usually, when buying a home outright, one of the first steps is we refer you to one of "Dr. I's" 'Golden Needle in a haystack' credit issue specialist lenders (see Financing or CONTACT US for more information) so you can pre-approve for the loan so you can buy the home. BUT, WHAT HAPPENS IF YOU FAIL TO PRE-APPROVE ? Would this mean you'd be stuck in a hopeless situation ? OF COURSE NOT ! For RadiantNewHorizonHomes.com is all about being able to get that 'Ideal Home' now ! No more endless waiting. Its about taking action to get you in your Ideal Home ASAP ! So, if you don't pre-approve due to credit issues, all is not lost for we can get you into a credit restoration program that can raise your scores so you can qualify for a mortgage so you CAN own that 'Ideal Home'. SO, WITHOUT FURTHER ADO, WE INTRODUCE YOU TO ... |

|

|

Just who are NEW BEGINNINGS CONSULTANT COMPANY (aka NBCC) ? |

|

New Beginnings Consultant Company (NBCC) is a credit restoration specialist with over 30 years experience founded with one vision in mind - to help people separate their damaging past from their promising future.

The Credit Bureaus label us with a number, but people are more than just a number. Why should we be forced to accept the costly consequences of that number ? NBCC is in the business of giving people back their good name and freeing them from any crippling numbers. Getting started is easy, just remember the 3 R's: Report, Review, Restore ...

|

|

STEP 1 - REPORT Go to Privacy Guard (touch image above for link) and get credit reports and scores for all 3 bureaus. STEP 2 - REVIEW Touch on image above for link to send in Privacy Guard credit reports for a FREE credit analysis. Your reports would be reviewed and you would be advised on what you would need to do to boost your credit. STEP 3 - RESTORE Touch on image above to enroll in the NBCC credit restoration program and let the credit restoration process begin ! This process includes reviewing all derogatory and positive information and disputing negative accounts to the respective credit bureaus. Multiple rounds of disputes are done to achieve the results wanted. In addition, there is a... MONEY BACK GUARANTEE !!! If your credit scores are not 640 or better within 12 months, you get your money back ! The guarantee is for 12 months but the average time to get 640 or better credit is 8-10 months assuming proper following of the program and advice given. And on top of that, NBCC also has a...

(Discount available for military personnel AND first responders) |

And that's not all ... FREE CREDIT RESTORATION ADVICE NBCC is in the credit restoration business (as opposed to credit repair) for a reason. Standard credit repair does not work ! NBCC has had tremendous success in helping people get their credit scores raised to a point where they can do things like buy homes, cars and so on. NBCC believes educated people make for the best relationships as knowledge is power... For example, did you know that one late payment can drop credit scores by 80 or more points ? If your credit is suffering in today's economy, NBCC can help. Spend some time to learn vital information about credit and the credit scoring formula. Read on... |

|

FINANCIAL MAKEOVER Money is a tool, not a trophy, BIG DIFFERENCE. The smart ones know the difference. It goes back to the idea that the "love of money is the root of all evil". Think about it, you can love a trophy, but who loves a hammer?? Use money to help yourself, your family and others. Learn how to make it, save it, and invest it. Learn how to make it work for you. Use it like a tool. Never abuse money to "show off" as a trophy or even "reward yourself". If you ever find yourself using your money like a trophy, stop and think. This spending behavior leads to stress, robs you of peace, and has a high price tag. Often people end up paying the price in failed marriages, health problems, lost homes, and drowning in debt with no hope of ever getting out. Trophies come with tremendous costs. If you want to learn how to use money like a tool, control your money and not have it control you, then spend some time here. We offer some life changing but simple steps to a total money makeover. Start to establish these simple financial habits: Pay Yourself First, Establish a Budget, Eliminate Debt and Automate Your Savings and Investments. You can do other things to improve your money situation while you're working on these steps. First, focus on the fundamental personal finance equation: to pay off debt, or to save money, or to accumulate wealth, you must spend less than you earn. SIMPLE BUT VERY IMPORTANT! Curb your spending. Re-learn frugal habits. While you work to spend less, do what you can to increase your income. If possible, sell some of the stuff you bought when you got into debt. Get an extra job. Finally, go to your local public library and borrow Dave Ramsey's The Total Money Makeover. Don't be put off by the title - this is a fantastic guide to getting out of debt and developing good money habits. After you've finished, return it and borrow another book about money. The most important thing is to start now. Don't start tomorrow. Don't start next week. Start tackling your debt now. Your older self will thank you.

|

CREDIT RESTORATION Not so sure how this works? Who can you trust? Skeptical of the credit repair industry? How does all this work? Does it really work? Our criminal laws are written courts in such a way that you're innocent until proven guilty. Following this reasoning, the Fair Credit Reporting Act was written the same way. So we take the same tact and position as a defense attorney, and we go after everybody that is accusing you of anything, and if they cannot prove their case to the extent that the law requires, then we demand that they remove it from your credit report. The complaints against the credit repair industry are many. Beyond the common complaints of fraud, scams, rip-offs, and the like, the biggest complaint by far is "it just doesn't work". Unfortunately, some of these accusations are true. There are many scam credit repair companies operating, and even if they are a legitimate company, often their best efforts do not help their customers enough. If the goal is to raise a credit score to qualify for mortgage loan and a credit repair company is enlisted to perform this service, the customer will be disappointed. It doesn't work. Just repairing the credit will not raise the score enough. Most credit repair companies focus solely on the removal of derogatory credit. Higher credit scores are the results needed, not just deletions of derogatory credit. So we go after the negative credit, but then we address the bigger picture. We help each client find opportunities to add positive credit to your file. This is the only method that works to raise a credit score significantly. A good score is comprised of good payment history, and good, open lines of revolving credit, with high limits and low balances. Our program goes after all aspects of your credit report. We successfully challenge the derogatory credit, and help you find opportunities to add positive credit. And this method works, you will have to trust us on this! |

|

ADDING POSITIVE CREDIT HISTORY To get a good credit score, you must have good credit reporting! You can't get good credit because when you apply for credit, you are denied because you have a bad score….and around and around it goes. We have broken that cycle for you! There are several easy ways to add positive credit history to your credit report. This short chapter will give you all the important information necessary to instantly add serious points to your credit score and start building strong credit references right away. Obtain pre-paid or secured credit cards This is another easy way to begin building rebuilding positive payment history on you credit report. A prepaid or secured credit card is a credit card that holds your money as collateral for the credit you use. There are many types of pre-paid and secured credit card accounts. The collateral used is always money. Most of these accounts require a security deposit equaled to the amount of the credit limit given plus a fee for the service. Other accounts are given a larger limit than the amount of collateral given. Not all of these types of accounts are reported to the credit bureaus, so if your goal is to improve your credit; be very selective in regards to the account you use. In addition many of these types of accounts charge excessive fees. The yearly fee should not exceed $150 for an average and reasonable major credit card. Obtain Secured Bank Loans Obtaining secured bank loans is easy and allows you to acquire excellent credit references using a simple technique we call the "Three Loan Maneuver". You will need at least $1000 to perform this procedure and get the desired end result, BETTER CREDIT! You will apply for 3 loans with 3 different banks in 3 days. On the first day take your $1000 to the 1st bank and request a secured personal loan with a minimum of 85% loan to value. This loan must be a minimum of a 12 month term, with minimum payments. This is the easiest type of loan to acquire because it is secured with cash. Most banks will loan 85% of the amount on deposit. Given the loan, the savings account becomes frozen. However, every time a payment is made, an amount equal to that payment becomes unfrozen, less a few dollars for interest. Ask that the loan be for at least one year, with minimum monthly payments. Monthly payments establish a payment history. You will not be turned down for this type of loan no matter what your previous credit history, and in most cases it will not be checked. If the loan officer is planning on checking your credit, and you have bad credit, tell them you are trying to re-establish your credit, and that a good credit rating is very important to you. In addition, make sure that this type of loan is reported to at least one of the major credit reporting agencies. Once an $850 loan (85% of $1,000) is obtained, take that money to another bank the next day and open a second savings secured loan for $722.50. (85% of $850 = $722.50)Then you repeat the same step again by opening a third savings account of $614.12 (85% of $722.50 = $614.12). You will only be able to obtain 3 loans if you only have $1000 because each loan requires an equal amount of collateral plus interest. Pay these loans off by doubling the minimum payment every month on time using the unfrozen funds that become available. Each time you make a payment you will free up funds that equal the amount you have paid minus interest. As long as you only use these funds to repay your secured savings account loan and you pay on time you will add positive credit references quickly. The interest rate should be very low and not cost you more then $30 per funded loan. |

If you have questions about NBCC and their credit restoration program,CONTACT US |

|

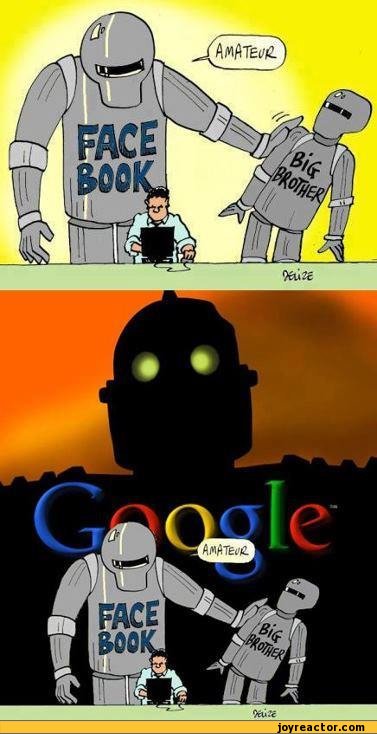

Before you leave this page, we would like to remind you that not every thought needs to be shared :-) or as it turns out : Posted or Tweeted. This is because lenders and other credit analysts are trending towards using your social media as data for determining your credit score and other risk factors for timely repayment. Example, is there mention of job loss or complaints about work? How about posting about being "wasted"? Party talk? Have your friends defaulted on loans? This will negatively impact you. "It turns out humans are really good at knowing who is trustworthy and reliable in their community," said Jeff Stewart, a co-founder and CEO of Lenddo. "What's new is that we're now able to measure through massive computing power." The power, reach and scrutiny of Facebook and other giant data collecting is un-nerving. Our advice? Use discretion when posting. No drunk texting or posting is always good advice. Once it is on the web, it is public data. |